If you have intentions of making cool wads of cash off the crypto scene when it comes to Binance paper trading, it would be wise to understand how this demo trading facility works and how it helps users practice completely risk-free trades.

When it comes to Binance Paper Trading, the line here just separates great traders from the average, and the inexperienced ones are practice and experience. Probably the most dangerous decision a beginning trader could make is jumping into trading headfirst with real money.

That is where paper trading comes in: the simulation of real trading, without running any risks, through the use of fictional trades with no real money in them.

In the trading world, Binance sits as one of the largest cryptocurrency exchanges in the world, which in turn means carrying enough tools and features for traders to learn, trade, and invest. But does Binance offer paper trading? You’d have to read on to find out.

What is Binance Paper Trading?

Paper trading is the method of new traders by which they virtually buy and sell assets without using real money. This is a manner of honing their skills and strategies in virtual space to gain valuable experience sans the risk of actual financial losses associated with trading.

That is to say, paper trading is some sort of ‘demo’ version of real trading where you get to see the market fluctuations, conduct virtual trades, and try different approaches. You get to feel the highs and lows of trading with absolutely no loss or gain.

This comes in particularly handy for complete beginners who just want to learn to trade without any sort of fear of losing any hard-earned money.

Does Binance Offer Paper Trading?

For now, there is no direct paper trading in the Binance main venue, so, this means that with this exchange, unlike some of the others, you simply do not have an option for which you would create a demo account and practice without using real money.

In any case, while Binance doesn’t have an inbuilt system of paper trading, there is all the same a way to practice trading on this platform without exposing real money.

These alternatives will let you simulate actual trading experiences in an absolutely secure and wide-open environment.

Alternative Options for Binance Paper Trading

While Binance itself does not directly offer paper trading, several third-party platforms and tools exist that connect to the Binance API and allow for paper trading. Here are some means of accessing demo trading:

1. Binance Futures Testnet

Does Binance provide a test network for trading futures? In fact, it’s something like a demo of their futures trading platform where one can practice the art of trading with some virtual assets.

2. Third-Party Paper Trading Platforms

Third-party platforms that have been integrated into the live market data from Binance and allow one to practice without funds include but are not limited to: TradingView is one of the available simulation platforms, providing demo accounts.

3. Manual Paper Trading

The alternative to that, though an equally simple and efficient one, is that of paper trading manually. One would track the market prices on Binance and keep a record of hypothetical trades using a spreadsheet or notebook.

As this will take more effort on your part, it is nonetheless great practice in a real-time market environment.

Is Demo Trading Possible on Binance?

Yes, Binance allows for demo trading; however, it’s not your typical type when you have some form of in-platform demo account.

As explained above, through the Binance Futures Testnet, you will have the ability to do demo trading of futures contracts. This becomes useful for those users that want to learn leveraging and futures without losing any real money.

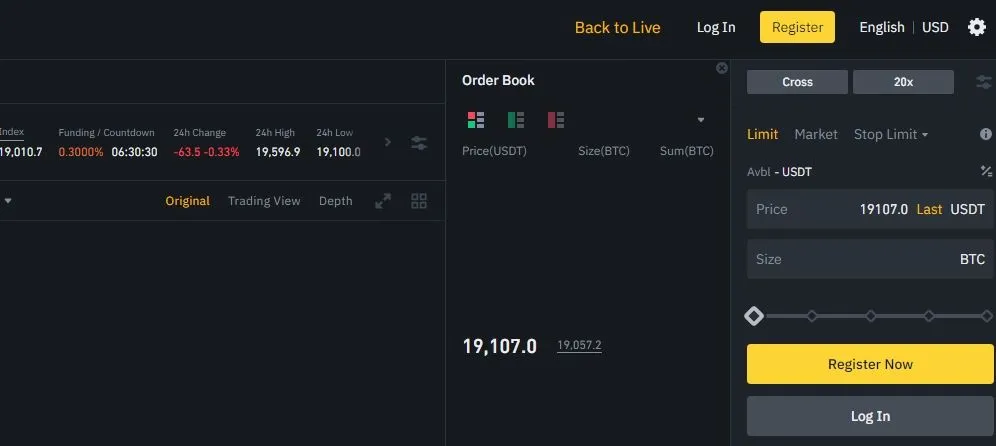

To access Binance Futures Testnet:

1. Log on to the website of Binance Futures Testnet.

2. Create a testnet account.

3. After signing up, a certain amount of virtual money is provided to the registered member for trading in a virtual future environment.

Apart from using the Testnet, one can further use other educational tools like Binance Academy or real-time market data to simulate trades manually.

In the case of spot trading, for instance, one can integrate other third-party services like TradingView or any other platform supporting demo accounts, in cooperation with the Binance API to perform fictitious trading.

Are there Binance Paper Trading Requirements?

Because Binance itself does not support paper trading, there is no specific requirement to start paper trading on this space, so the answer to your question is no.

But then, if using third-party tools or the Testnet from Binance Futures, you will most likely have to create an account on these platforms. Here are general requirements to paper trade using third-party tools or Binance’s Futures Testnet:

1. Create a Binance Account

You’ll need the Binance account to either access real market data or access to the Futures Testnet. Of course, creating an account with them is free and easy.

2. Use of Third-Party Tool

If you are going to do a simulation of your spot trading, then you need to connect Binance API to third-party platforms like TradingView.

Lastly, if you want to paper trade futures, you need to register here – the Binance Futures Testnet is where you can use fake money for trading.

What are the Advantages of Paper Trading on Binance?

The act of paper trading or demo trading on Binance, or through third-party apps would bring several advantages, especially for newbies, like:

1. Risk-Free Learning

One gets to learn how to trade with paper trading without losing any real money. This is the best way to build confidence in one’s strategies.

2. Strategy Testing

Be it trying a new strategy or refining an old one, paper trading offers you an avenue to test these without the pressure of financial loss.

3. Binance Familiarity

Paper trading allows the newer trader to become accustomed to the Binance platform-the way it works and how the cryptocurrency markets work.

This also lets the trader determine how well this particular strategy they have adopted will pay off in the long run. One is able to track his or her trades and find what’s working for him or her great before even spending real money.

Conclusion

While Binance doesn’t have any inbuilt option to paper trade in the case of spot trading, ways to learn and practice on this platform don’t finish.

This could be through Binance Futures Testnet, third-party tools, or just your simple tracking of profit and loss-but it forms an important tool even for experienced traders.

It would give an opportunity for one to learn different strategies, get familiar with the market, and build up one’s confidence without losing a single penny. So, by the time one transitions into actual trading, it will be a lot easier if he has already been practicing and perfecting himself in preparation for real time.

That is where paper trading on Binance is particularly good when one wants to get into cryptocurrency trading and does not want to jump into the deep. Use the tools, perfect the strategy, and make your foray into the actual trading when you feel ready.