What is Bitcoin Extractor? An Educational Guide

Hey, have you heard about the phrase bitcoin extractor as a new bitcoin trader who is yet to get acquainted with the language of blockchain? If you have little or no idea of what the concept entails, kindly stay on this page while we get you enlightened.

Bitcoin extractors or Bitcoin address extractors are specialized instruments that are created to examine transactions on the network. These tools are important for tracking, mapping, and tracing Bitcoin transactions.

A second usefulness of this tool is offering insightful information for forensic analysis, regulatory compliance, and transaction monitoring, among other uses.

Understanding Bitcoin Extraction

Bitcoin is powered by blockchain, a system at the heart of numerous cryptocurrencies. A blockchain is a distributed ledger that tracks all activity on a network.

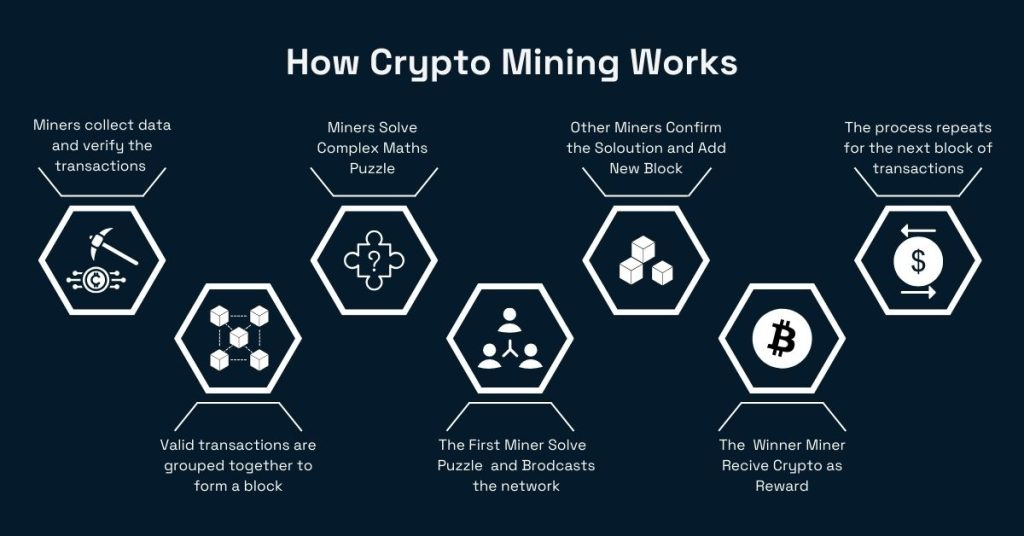

A block is a group of transactions that have been accepted and are linked together to create a chain. Mining is the method of adding a block to the Bitcoin network. There are 420 million crypto users worldwide in 2024.

Mining is an essential part of Bitcoin and other cryptocurrencies because it gives users a reason to put correct information into a shared ledger that keeps track of transactions and sums on the blockchain network underneath it. In this process, people who mine for Bitcoin struggle for the rewards.

Normal people might find mining confusing because it is based on complicated code that is meant to end fraud and theft. Bitcoin mining often requires expensive, specialized equipment that can cost hundreds or thousands of dollars.

Bitcoin as we know it can not be possible without mining. The “proof-of-work” system can not work without Bitcoin mining. This keeps thieves from taking your Bitcoins and ensures that you get them when you ask for them.

Is Bitcoin Mining Worth it?

To answer this question, you need to carry out a cost-benefit analysis (using online calculators) to determine if Bitcoin mining is profitable. A cost-benefit analysis is a method that companies use to determine which actions should be taken and which should be ignored.

Assess your willingness to invest the needed initial funds in hardware, as well as the future value of Bitcoin and the level of difficulty before committing your resources. It is also essential to study the difficulty of the cryptocurrency you want to mine to determine if the mining operation would be profitable.

When both bitcoin prices and mining difficulty drop, it’s usually a sign that fewer miners are mining bitcoin and that acquiring bitcoin is easier. Nevertheless, with increasing bitcoin prices and mining challenges, you can expect an increase in the number of miners competing for a smaller supply of bitcoin.

How Does Bitcoin Mining Work?

Mining (in general, blockchain mining) is a nice and bad way to sort through data because it uses economic rewards. The third parties who are in charge of setting up deals are spread out, and nice behavior is financially rewarded. On the other hand, everyone who does something wrong wastes money, as long as a lot of people are honest.

In Bitcoin mining, this is done by making numerous blocks that can be shown mathematically to have been stacked in the right order. This needs a certain amount of resources. The process is based on the math behind an encrypted hash, which is an acceptable way to encode data.

Hashes are one-way encryption methods, so it is almost impossible to get back to the original data until every possible combination is tried and the result fits the specified hash. So, how would you mine Bitcoin?

Every second, they go through trillions of hashes until they see one that meets a condition called “difficulty.” Both the difficulty and the hash are very large bit-based numbers, so the condition just says that the hash has to be smaller than the difficulty.

To keep the block time the same, the difficulty is adjusted every 2016 Bitcoin block, which is about two weeks. Block time is the amount of time it takes for Bitcoin miners to find each new block.

The information in the block header is used by miners to form a unique name for each block. This is called a “hash.” The Merkle root is the most important component of a hash, which is an extra aggregated hash that includes the signatures of all the transactions in that block, as well as the unique hash of the block preceding it.

This implies that even a small change to the data in a block will change its projected hash and the hashes of all blocks that come after it. Nodes would immediately say no to this fake blockchain, which does stop network disturbance.

The mechanism assures that Bitcoin miners perform actual labor — the time and energy expended in sorting through all conceivable combinations — through the difficulty requirement. This is why Bitcoin’s consensus protocol is referred to as “proof-of-work,” to distinguish it from other block-creation mechanisms. Malicious organizations have no choice but to replicate the network’s full mining capacity to attack it. In Bitcoin, this would cost billions of dollars.

However, how much time is needed to mine a single Bitcoin? The generation of a single Bitcoin typically takes roughly ten minutes, while this timeframe is only achievable with powerful CPUs. The Bitcoin mining hardware you use is the major factor that determines the mining speed.

Conclusion

In this article, we have discussed everything you need to know about Bitcoin. Bitcoin mining is an important part of the world of currency, and it serves many different purposes in the Bitcoin network. This is how new bitcoins are made, how transactions are checked and added to the blockchain, and how network security is arranged.

Bitcoin mining is needed to validate and confirm new blockchain transactions and discourage bad players from double-spending. It is also the method new bitcoins are added to the system. We hope this blog may be helpful for you.