What is Bitcoin Naar Euro?

“Discover what Bitcoin Naar Euro means, how the value of Bitcoin influences the Euro, and how to purchase Bitcoin in Euros, as well as why Bitcoin is considered a revolutionary digital currency.”

First to be known as the cryptocurrency, Bitcoin has caused a storm in the financial world. The time people find out about the concept of Bitcoin in different parts of the world, the term “Bitcoin naar Euro” is commonly employed.

When translated to the English tongue, it reads “Bitcoin to Euro,” which, straightforwardly speaking, means conversion of Bitcoin into Euro currency.

The following detailed guide will cover how Bitcoin originated, its connection to the Euro currency, and steps in which someone can buy Bitcoins with Euros.

We’ll also discuss who came up with Bitcoin, how fluctuations in the price of Bitcoins affect the Euro, and whether or not you are able to invest in Bitcoins using Euros. Finally, we will tie these components together in a narrative conclusion.

Who Created Bitcoin?

Bitcoin was invented in 2008 by a person or group of persons under the name ‘Satoshi Nakamoto.’. The invention of Bitcoin upended the finance world, providing a decentralized currency option outside of the central authority, such as a bank or government.

Nakamoto publicly released the whitepaper titled *Bitcoin: A Peer-to-Peer Electronic Cash System* about its blockchain technology.

Now, this blockchain technology is the basis behind allowing secure, transparent, and immutable transactions that allowed all other future cryptocurrencies to be developed.

Bitcoin was officially launched in January 2009, when the network’s first block, actually called the ‘Genesis Block,’ was mined.

Fast forward to today, and Bitcoin has become a global phenomenon stirring interest in traditional financial systems and producing heated debates about the future of money.

How Does Bitcoin Relate to the Euro?

Bitcoin and the Euro are two kinds of money. The Euro is a classic fiat currency controlled by the European Central Bank, while Bitcoin is a digital currency in a decentralized manner, self-regulated by its code and community.

Bitcoin presents a strong challenge to traditional fiat systems and gives individuals total control over their money. This fact makes it attractive to people seeking independence from government-controlled monetary policies.

There’s also the area of market volatility, as Bitcoin prices are known to be very volatile, which often sends shockwaves into the mainstream financial markets. This usually dents investor confidence and affects the strength of the Euro in global markets.

The European Union has sought to regulate Bitcoin and other cryptocurrencies as a means of preventing criminal activity, such as money laundering. In any case, such regulations had been made in an attempt to integrate Bitcoin safely within the financial ecosystem.

Can You Buy Bitcoin in Euros?

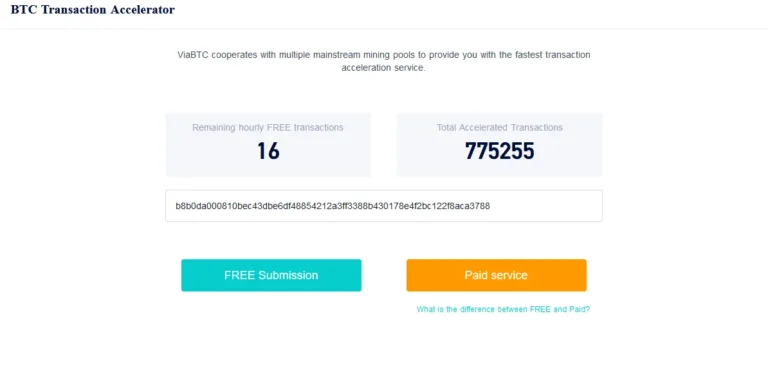

This is absolutely possible, as one can buy Bitcoin using euros. As many top cryptocurrency exchanges or platforms allow direct Bitcoin purchases. The process is rather simple, with:

1. Choose a Cryptocurrency Exchange

Choose a good cryptocurrency exchange that may support the Euro transaction, via popular options like:

- Coinbase

- Binance

- Kraken

- Bitpanda

2. Account Creation

Sign up on the selected platform and get verified. Most exchanges would want: name and Email Address Verification of identity via Government-issued ID.

3. Adding Euros

Deposit Euros into your account using any of these deposit methods listed: – Bank Transfer – Credit/Debit Card. E-wallets such as PayPal or Skrill (if supported).

4. Purchase Bitcoin

Head to the trading section, select Bitcoin as the cryptocurrency to buy, and specify Euros as the payment currency. Next, choose the desired amount, and the platform will calculate the Bitcoin equivalent.

How much is 1 Bitcoin?

The value of 1 bitcoin in euros can fluctuate according to market conditions. Today, 1 Bitcoin stands at around ‘€27,000 to €30,000.’ on the platform and according to market demand. This because:

1. Market Demand and Supply

When the demand exceeds while the supply remains constant, then the price of bitcoins goes high.

2. Global Events

Events such as government regulations, technological changes, or economic turmoil may have an impact on the value of Bitcoin.

3. Investor Sentiment

Good news or bad news about Bitcoin influences investor attitude, hence its market price.

Is Bitcoin above the Euro?

Bitcoin’s rise in popularity has spread fear about its impact on traditional or fiat currencies like the Euro. On the contrary, Bitcoin, though it possesses many advantages, does not directly threaten the Euro today.

The primary purpose is an investment asset; the Euro, on the other hand, has traditionally been used as a medium of exchange for the majority of its users.

Now, the European Union controls cryptocurrencies so that they complement and do not replace existing monetary systems.

While Bitcoin is gaining momentum, the Euro is deeply entrenched in the economies within the Eurozone and thus harder to dislodge.

How Does Bitcoin Affect Eurozone Policies?

Blockchain technology presents a challenge for the Eurozone to uphold its traditional monetary policies.

Governments and central banks within the Eurozone embark on crafting the right policies that are friendly towards cryptocurrencies while maintaining financial stability at the same time.

1. Policy Developments

The European Central Bank is working on a digital Euro that would rival other cryptocurrencies like Bitcoin. Examples 1. CBDCs (Central Bank Digital Currency)

2. Taxation and Regulation

Countries in the Eurozone are putting into place tax policies and legal frameworks to effectively regulate the use of cryptocurrencies.

A Final Note

In this regard, the term “Bitcoin naar Euro” really goes to show the growing interaction between the two currencies, for it makes the global reach possible so that it can be used to operate and connect the digital and fiat worlds.

As we’ve explored, Bitcoin offers financial freedom, decentralized governance, and innovative technology. Its relationship with the Euro is one of coexistence rather than competition, with both currencies serving unique roles in the modern economy.

The investment in Bitcoin is really exciting for Europeans, who will be directly buying the investment using the Euro. This can involve joining the cryptocurrency revolution with more security and regulatory assurance.

Knowing the dynamic of Bitcoin with traditional currencies like the Euro is ever-changing in the world of finance. An investor, a trader, or anyone out of curiosity—the journey of Bitcoin to Euro is symbolic of the future of money in a digital age.